Liquidbees with Systematic Trading - Aggressive

Nifty Only is a SEBI registered (Investment Advisors no. INA000007526) investment advisors who provide thoroughly researched advice for any or all of your financial needs with the help of our team of professional experts with vast domain knowledge and experience.

We intends to be one stop solution for all your financial needs including wealth creation (through different Investment advisory schemes) and catering to other financial requirements.

Due diligence of the client and their risk profile shall be done before suggesting any of the investment or trading advice.

Execution of agreement between client and advisory is mandatory.

All the illustrated figure are indicative and does not guarantee any return.

Investment Objective:

- To create fixed income and additional income with Systematic Trading and gradually build Long Term Multi Bagger portfolio with Systematic Trading in the process try to outperform Nifty returns over a longer term period.

- The core objective of the Strategy is to achieve risk adjusted capital appreciation outperforming Nifty for dynamic clients.

Investment Strategy:

- The Strategy intends to hedge long term investments and also capitalize on Medium to short term Trends of the Index.

- It is designed in a way to buy Liquid Bees / Onlylong portfolio and to run systematic trading models to generate additional returns.

- It takes into consideration more parameters (as compared to other Strategies) to enter into the trade.

- It is quite dynamic.

- It trades in proportion of 1:5 (i.e. Liquid bees 50% & Systematic Trading Margin MTM 50% .

Investor Suitability:

- This Strategy is suitable for PMS investors and dynamic traders.

(One of the criteria to determine Client risk profile would be on the basis of Ratings of Nifty Only questionnaire with authentic information filled by client).

Investment Approach:

- Ideal time horizon for Investment / Lock in Period: Minimum 18 Months/No lock in

- Exit Policy: As per Agreement

Fee Structure: As per Agreement

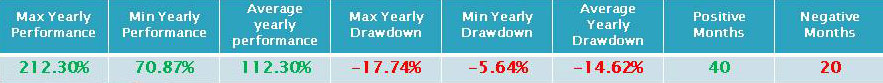

Performance Highlights

- Investment: Rs.1Cr for Asset Under Management (AUM) of Rs. 5 Cr

- Since FY 14-15,5 Positive years

- Average Returns per unit of Risk for 5 years: 1 : 9.56

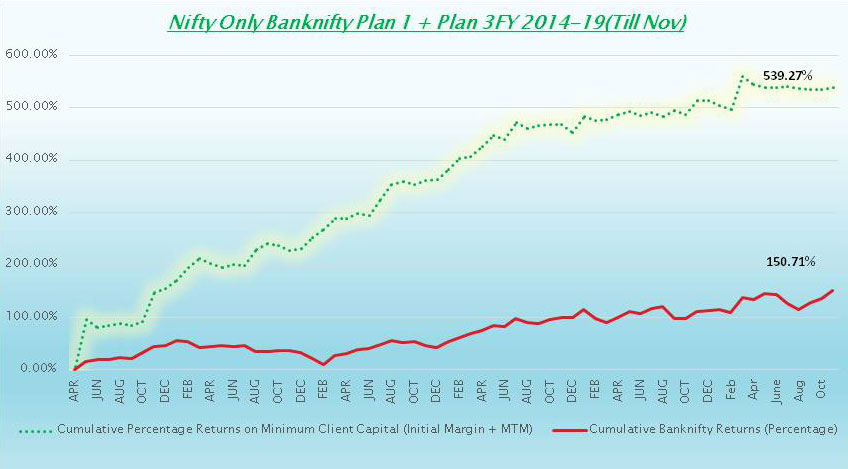

Indicative Cumulative Gross Out-performance Graph of Liquidbees with Systematic Trading on Capital of Rs. 1 Cr for 5 Years

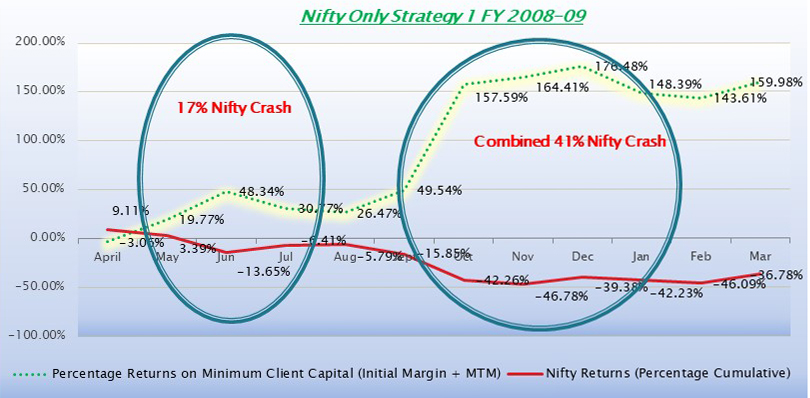

Worst Scenario Outlook

Indicative details for Period 2014-2019

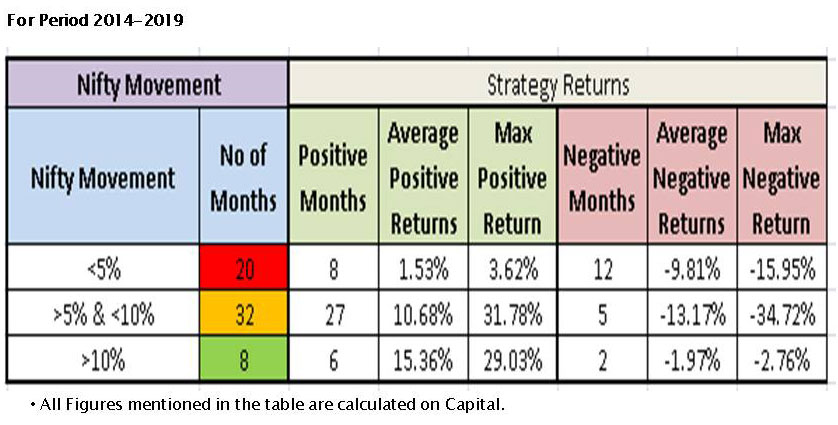

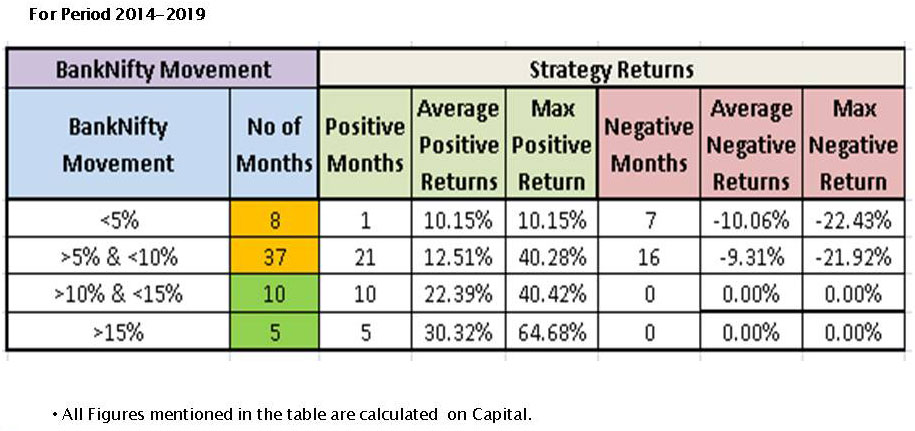

Worst Scenario Outlook

Combination of Indicative Performance of Investment + Trading

- All the above mentioned figures are indicative which does not guarantee returns in future.

- All figures given are back-tested as per strategy designer and highlighted only to get an idea of the performance & risk and reward of the strategy.

- Investors and Traders need to understand all the characteristics of the model before starting to trade.

- Ideal Tenure for Trading the strategies would be minimum of 18 months.

- Do not trace MTM movements on daily, weekly or Monthly basis.