Investment Conservation Strategy

Nifty Only is a SEBI registered (Investment Advisors no. INA000007526) investment advisors who provide thoroughly researched advice for any or all of your financial needs with the help of our team of professional experts with vast domain knowledge and experience.

We intends to be one stop solution for all your financial needs including wealth creation (through different Investment advisory services) and catering to all other financial requirements.

Due diligence of the client and their risk profile shall be done before suggesting any of the investment or trading advice.

Execution of agreement between client and advisory is mandatory.

All the illustrated figure are indicative and does not guarantee any return.

Investment Philosophy:

The Biggest Risk in life is not to take any Risk – Mark Zuckerberg.

Although Equity Investments are perceived to be riskier assets than the conventional High grade Debt securities and Gold (Safe heaven), historically long term Investments in good quality Equities has proved to be far more remunerative and huge wealth creators for Investors.

As rightly said “Form is Temporary – Class is permanent", high quality companies have been able to overcome the market mayhems and economic turmoil and are able to emerge better and stronger commanding even higher valuations.

Also Fundamental equity Investments serves as the best tool to beat Inflation.

Investment Philosophy:

Ideal Equity exposure in an Individual’s portfolio relative to the person’s age

Equities Outperformance over other asset classes since 1981

Investment Objective:

- To provide long term investors with risk adjusted capital appreciation that can deliver consistent outperformance over benchmark equity index.

- Thus the core objective of the Strategy is to achieve long term compounded Capital appreciation on the basis of stringent criteria based stock selection with calculated Risk.

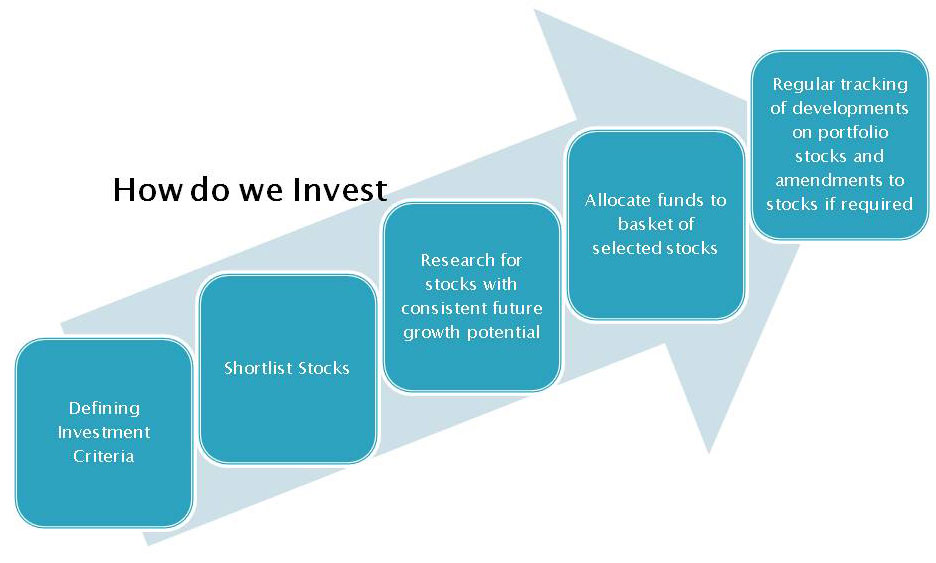

Investment Strategy:

- The Strategy intends to capitalize on a long only stringent criteria based stock selection.

- It is designed in a way to create a portfolio of high quality stocks that qualify our stringent criteria across diversified sectors.

- The Portfolio would be equally divided among the number of stocks selected.

- Investment in high risk reward stocks may be avoided.

- Further we would be regularly tracking the developments on the stocks if it consistently performs to remain a fit in our stringent criteria based portfolio.

Investor Suitability:

- This strategy is suitable for Conservative long term investors targeting above index compounded absolute returns. (One of the criteria to determine risk profile would be on the basis of Ratings of Nifty Only questionnaire with authentic information filled by client)

Investment Approach:

- Investment: As per client appetite

- Ideal time horizon for Investment / Lock in Period:Minimum 3 – 5 Years/No lock in

- Ideal number of stocks in the portfolio (Diversification):15-20 (Approx not more than 5-7% exposure in a single stock)

- Market Cap Portfolio Mix: Large Caps 70-75% Small Caps: 25-30%

- Exit Policy: As per Agreement Fee Structure:As per Agreement

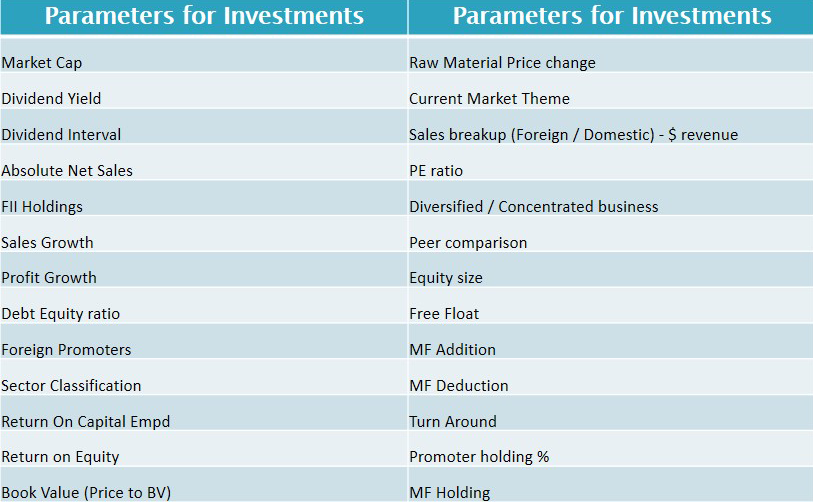

Core Parameters to define the Stock selection criteria

- Promoters

- Fundamentals of the company

- Key ratios

- Growth consistency

- Present shareholding pattern

- Future outperformance

- Cycle of Investments

Other Key parameters for Stock selection

Stock Recommendation Illustration with description

Maruti:

- Fulfils all the selected criteria

- Consistent market leadership

- Consistent growth and innovation (Launch of new car models across different segments, upgrading new technology for fuel efficient engines, affordability, Pan India set-up).

Asian Paints:

- Fulfils all the selected criteria

- Boom in real estate leading to demand growth

- Falling of raw material prices aiding to margins

Yes Bank:

- Fulfils all the selected criteria

- High credit growth economy

- Comparatively smaller base effect leading to higher growth

Combination of Indicative performance of Investment + Trading

- All the above mentioned figures are indicative which does not guarantee returns in future.

- Investors need to understand all the characteristics of the model before investing.

- Kindly do not trace stock price movements or portfolio valuations on daily, weekly or Monthly basis

- Investments may be vulnerable to short term sharp market corrections, however since our criteria based stock selection would ensure high quality stocks portfolios, typically these companies over a longer term have been able to overcome the short term market mayhems and economic turmoil and are able to emerge better and stronger commanding even higher valuations.